$STFX - The protocol to enable copy tradooors ape with confidence

Modern-day investors. Increasingly social, self-taught and online.

What is STFX?

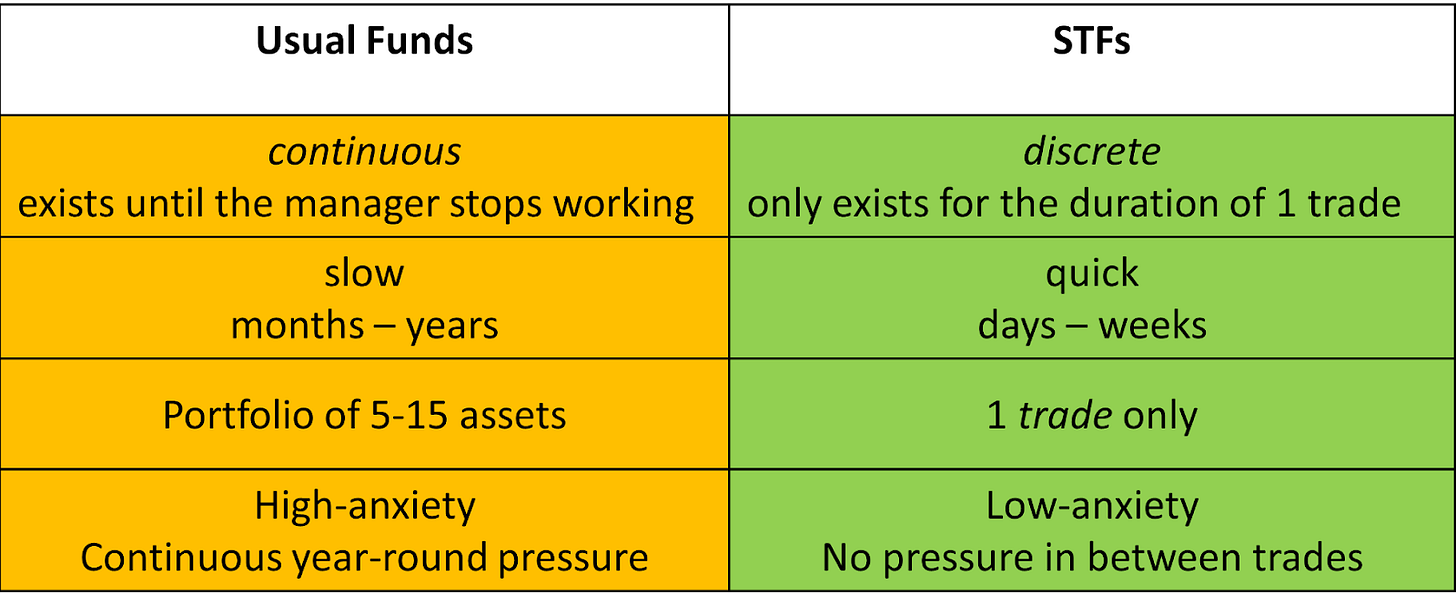

STFX (Single Trade Fund Exchange) is a DeFi and SocialFi protocol for short-term asset management. The main pioneering concept in this are STFs (Single Trade Funds).

A DeFi marketplace for investable trading ideas. This is aiming to essentially unbundle active portfolio / asset management into bite-sized pools. Another way it can be thought of is as a hedge fund that raises capital for a singular trade idea (rinse and repeat).

These are short-duration, non-custodial, active vaults dedicated to just 1 single trade. This stands in contrast with the majority of funds that exist in TradFi / DeFi until now which are continuous, longer-term, mostly multi-asset and often custodial (especially for current copy trading services being present only in CEXes).

There really isn’t a product in Tradfi that fits these characteristics. With the advent of trading in general, and the increasingly social aspect of trading - this seems like a ripe opportunity.

One can think of it with several analogies such as the follows;

Kickstarter / AngelList for trading (bootstrap trade ideas)

TikTok for trading (instant gratification, short time commitment)

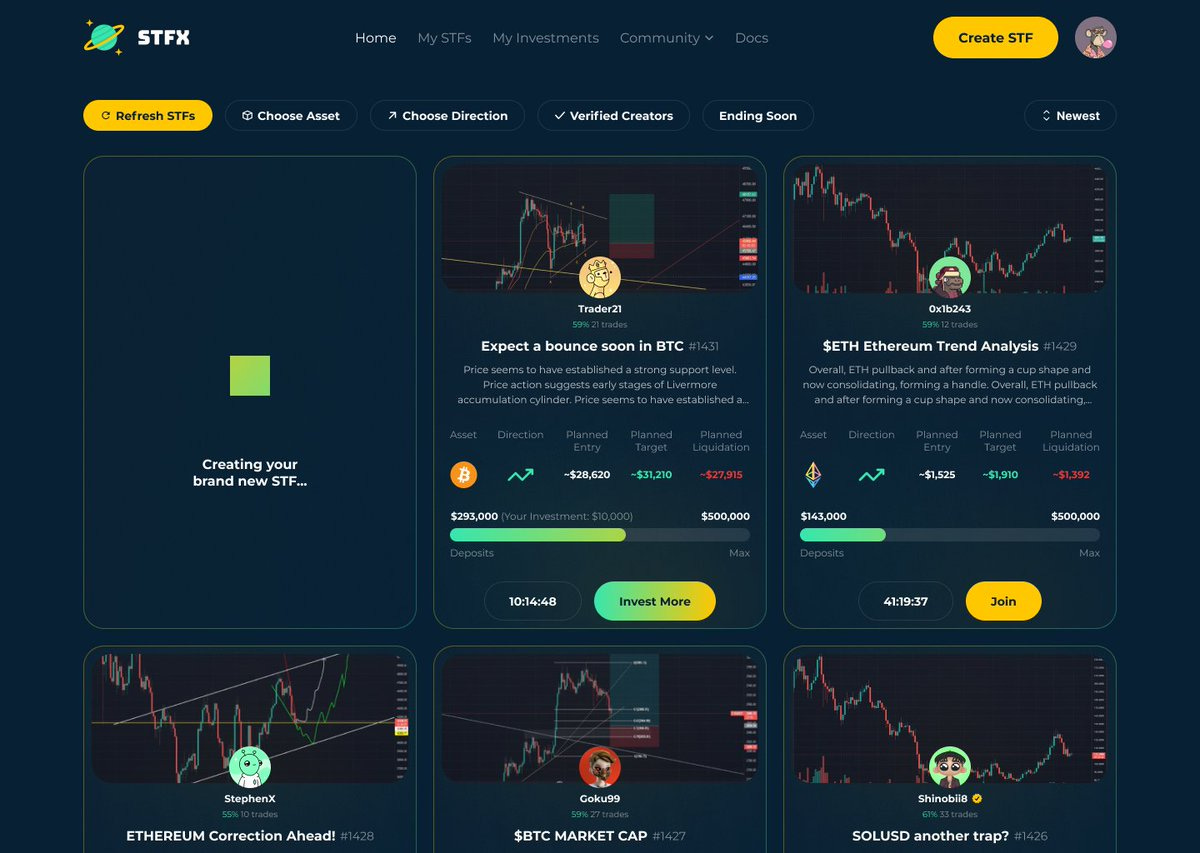

User → Ability to access an open, competitive marketplace for investable trade ideas

Trade managers → Ability to monetize their own trade ideas. Until now, besides sharing your trade setup on Twitter / elsewhere for social clout, there has been no way to monetize these ideas on-chain.

Traders get 15% to 17% profit sharing from all the money that got pooled into their STF on winning trades.

Most retail traders aren’t the most proficient at trading. This provides them an easy, no-commitment manner to copy trade smart traders. The next-gen protocol for copy tradoooors.

Some extra bits of information

How to track trader performance? —> There will be a profile for each ratio with basic parameters like win/loss ratio and more.

Roadmap —> Testnet in August

Tech behind STFX —> Built on Optimism, an ETH L2. Trades are routed through Perpetual Protocol (derivatives dex). So liquidity and trade pairs could be a potential hindrance (won’t be able to trade the more ‘exotic’ coins but those will have poor liquidity anyways. Anyways this is transient and more exchanges can be added.

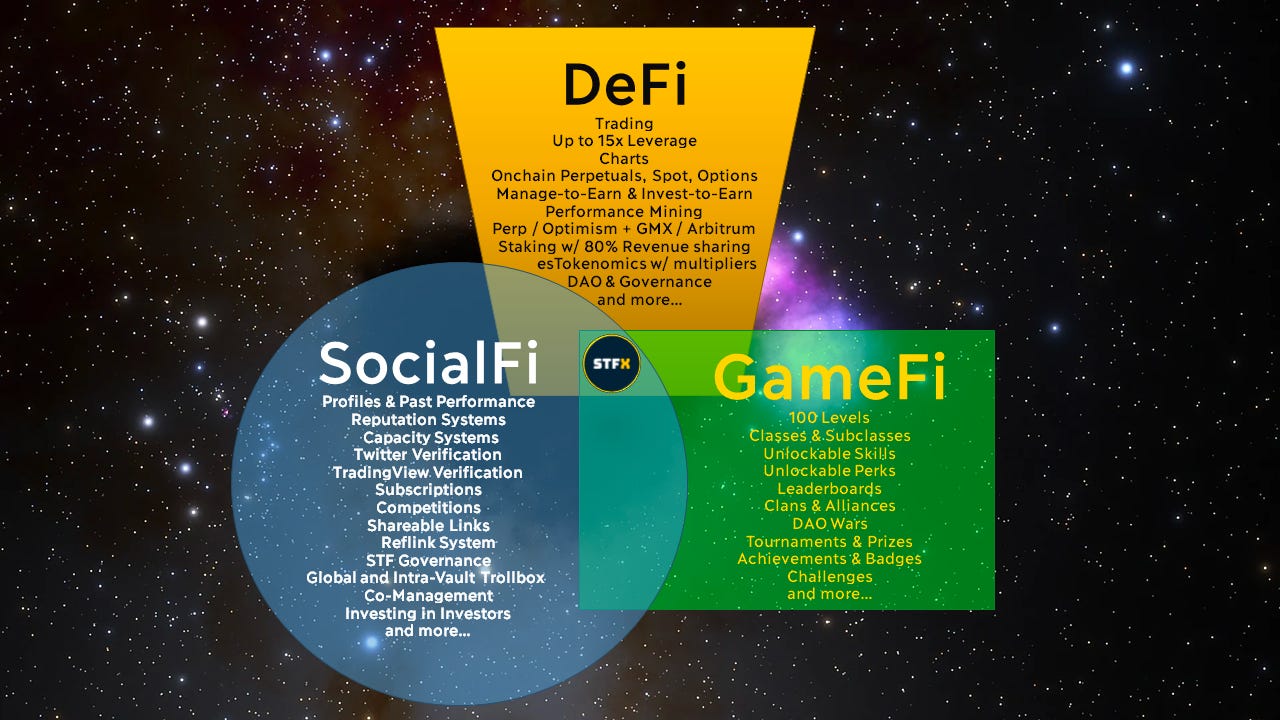

An amalgamation of DeFi/SocialFi/GameFi

One of the key aspects in STFX is the social aspect.

For managers, their on-chain trading reputation will be most important to them, as rep impacts their STF capabilities. For example, building a higher trading reputation allows managers to publish greater than 1 STF vault at one time and also be allowed greater capital capacity in each STF.

Traders are not only incentivised by getting extra leverage on their trade ideas in the form of pooled capital, but also the challenge of documenting their trade history / performance on-chain.

The team calls this ‘Dynamic Onchain Reputation’. This is important because traders often have peaks and throughs in their performance, so a dynamic rep system demonstrates real-time performance to investors. Some traders perform better in a bull trend, some vice-versa.

For example, I, personally may perform better in a bull trend and not so well in a bear trend. In that case, it might be a good idea for me to find a trader on STFX who has a good rep deep in a bear trend and follow their calls.

Why? The Opportunity - The rise in ‘copy trading’

Similar to investment syndicates in the past, social investing is not a new phenomena.

In the digital world, E-Toro was one of the first to bring such an offering in 2010.

According to a 2021 study by CNBC, social media is now the top source amongst 18-to-35 year-olds for investment ideas. Amongst which, copy trading is a fast-growing subsect.

OctaFX and E-Toro great examples of tradfi copy trading platforms, whilst Bybit and Bitget are good crypto-focused copy trading platforms. None are self-custodial or on-chain.

The culture of copy trading / apeing is very evident within crypto. HsakaTrades (A large CT account) is a prime example where a lot of degens/traders ape into the coin he tweets about.

A simple glance at the comment section of most CT ‘influencers’ / traders are just a constant ramble of people asking what token to buy. People want to outsource work to people they trust / look upto.

However, such copy trading (more akin to social investing) does not provide copy traders with any sort of a framework. They need to execute themselves with incomplete information. It is also a slippery slope as we do not know whether the poster is using said post for exit liquidity. There is no transparency.

One can also look at the large volume of paid trading groups out there. STFX opens up the floor, so to speak, to everyone without any commitments.

Ape, forget for a few months, ape again. Do as you please without any commitments.

Tokenomics

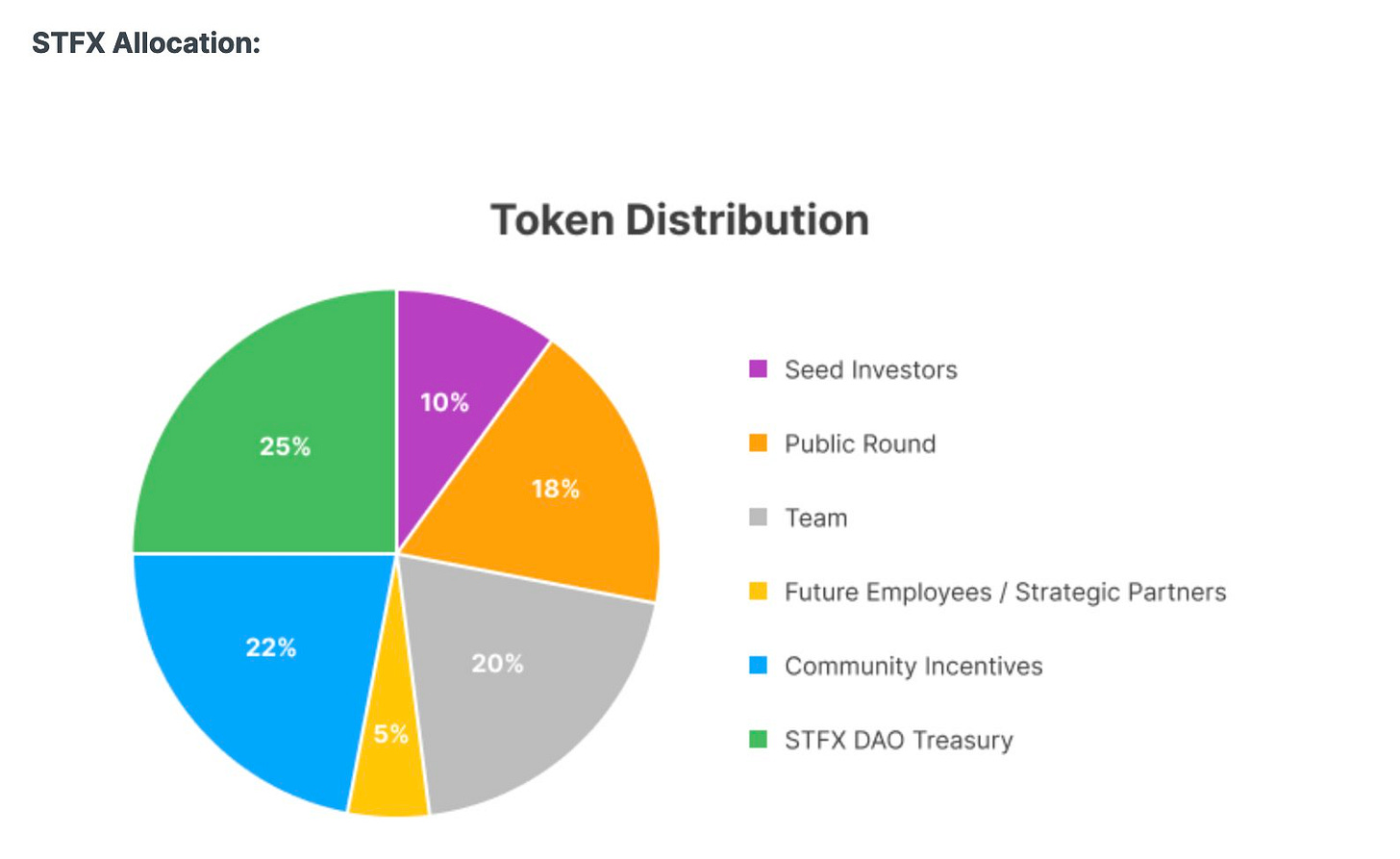

Supply: 1 billion hard cap with deflationary properties over time.

65% for the community, 35% for team/insiders. Not too shabby.

Utility token which will service functions within the network.

Protocol revenue —> 0.3% commission fee for all STF vaults debited post-fundraise completion. 3% performance fees on all STFs that close in profit. Not applicable to losing or breakeven trades.

Token value accrual —> Stakers to receive 80% of protocol revenue. 20% to go the DAO treasury. Rewards will be paid weekly to stakers with staking being subject to a 1 week cooldown period.

Token functionalities

Fee rebate → Stakers will get fee reduction and rebates on STFs

Governance → Participate in governance decisions such as, fee structure, integrating new DEX protocols, changing vault capacities, adding new tradeable instruments.

Priority Access → Large STFX stakers can get early access to high-profile manager STFs that may otherwise be heavily oversubscribed. Imagine a GCR/Hsaka (large CT accounts) STF.

STF Advertising → Stakers (who are managers) can get higher visibility on the protocol’s discover page and hence find it easier to attract capital to their STF.

Concerns?

How to prevent traders going around a STF and doing it on my own? And how can it prevent predatory counter-trading to popular / large STFs?

Every STF will have a very brief fundraise period. Some parameters such as prices / theses / asset / direction will be binding, some won’t be binding. As trades will be manual, bad actors won’t know how/when the trades are executed.

Managers also have ability to hide 1 trade parameter and as they gain rankings, they will be able to hide more than 1 parameter. Timing and execution are the bigger things in trading vs idea generation. I am sure people who actively trade understand.

Regulations?

Given the rise of copy trading in general - I do not think this would be a large concern.

Closing Thoughts

Social way to connect degens / traders and make money without a long-term capital commitment.

As a full time trader - this idea is exciting to me as crypto has not had any trader-specific fund structures develop as of yet. Mobility of funds is one of the most important functionalities for traders.

There are a lot of people who hate to lock away their capital for any specified periods of time (especially right now when trust is not at its highest given the regular exploits and mismanagement of funds in both DeFi and centralised funds).

The on-chain rep-based social aspect should also foster a greater sense of competitiveness, as traders seek both capital and social clout.

This hits all the boxes to go far given team keep shipping and is able to market interest amongst traders and retailers to get the ball of liquidity rolling.

Extra notes

Team have indicated the suite of products available will increase in the future to the likes of NFTs and options etc.

*All of these are just my personal ramblings and not financial advice*